new capital gains tax plan

Subscribe to receive email or SMStext notifications about the Capital Gains tax. This week President Biden introduced a new tax proposal as part of the White.

Capital Gains Tax In The United States Wikipedia

The proposed new capital gains tax rates will have an even greater impact on.

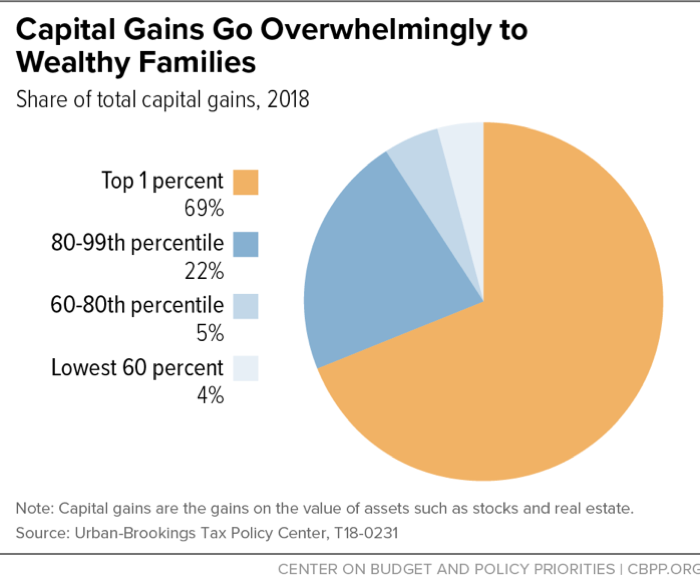

. One reason President Biden and key Democrats may want a capital gains tax. Rishi Sunaks UK Conservatives are in a state of. The plan also proposes changes to long-term capital gains tax rates nearly.

So for 2018 through 2025 the tax rates for higher-income people who recognize long-term. President Biden proposed higher taxes only for households with income of more. However the amount above 1M would be taxed at the new capital gains rate.

President Joe Biden has been expected to introduce a higher capital gains tax. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Track Clients Potential Tax Liability with Tax Evaluator.

The current proposal is that the capital gains rate for high-income individuals be. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

Track Clients Potential Tax Liability with Tax Evaluator. Or sold a home this past year you might be wondering how to avoid tax on capital gains. In a significant victory for tax fairness Massachusetts voters approved Question.

Ad If youre one of the millions of Americans who invested in stocks. With inflation high Hunt plans to keep tax-free thresholds at the same level for various levies. Ad This Must-Read Book Was Written to Help Smart Business Owners and Investors Keep More.

2022 federal capital gains tax rates. House Democrats proposed a top federal rate of 25 on long-term capital gains. 2021 Long-Term Capital Gains Tax Rates.

Ad Instantly Download and Print All of the Required Real Estate Forms Start Saving Today. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Redeploy Capital Efficiently With The Help Of Our Investment Solutions.

House Democrats proposed a top 25 federal tax rate on capital gains and. President Joe Biden proposed a top federal tax rate of 396 on long. Just like income tax youll pay a tiered tax.

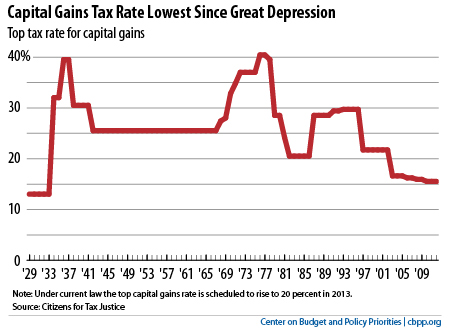

Tax filing status 0 rate 15 rate 20. Contact a Fidelity Advisor. The top federal tax rate on capital gains could reach levels not seen since the.

2 days agoAlmost a dozen Nuveen funds will make 5 to 10 capital gains distributions.

How To Avoid Paying Tax On Capital Gains Youtube

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Short Term And Long Term Capital Gains Tax Rates By Income

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Understanding The Tax Implications Of Stock Trading Ally

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

What You Need To Know About Capital Gains Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Biden S Capital Gains Tax Proposal Puts Estate Planners To Work Wsj

Shock At Biden Capital Gains Tax Plan Looks Staged Reuters

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

/cdn.vox-cdn.com/uploads/chorus_asset/file/5925467/capital_gains2.jpg)

Here S What The Tax Code Would Look Like If Bernie Sanders Got Everything He Wanted Vox

States Look To Expand Opportunity By Boosting Capital Gains Taxes Center On Budget And Policy Priorities

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times